AS SEEN IN:

Thousands Are Checking Daily To See If They Are Eligible For This Burial Insurance Program

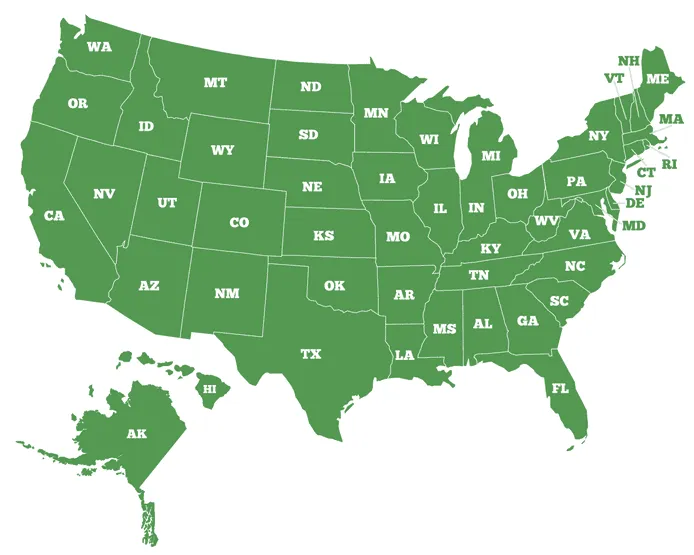

(But It’s Not Available in Every State)

New Burial Coverage Program Is Helping Seniors Cover Funeral Costs Even With Health Issues

“I didn’t think I’d qualify. But after answering a few simple questions, I was approved — and now I know my family won’t be left with the bill.” – Barbara M., 72, Arizona

Are you over 50 and worried about the financial burden your funeral might leave behind?

You’re not alone. With the average funeral now costing between $8,000 and $12,000, many families are caught off guard — and forced to dip into savings, go into debt, or even launch crowdfunding campaigns.

But thankfully, there’s a way to lock in burial coverage today that could help protect your loved ones from that stress — and it doesn’t require a medical exam.

A New Burial Benefit Is Now Helping Seniors Cover Final Expenses — Starting at Just Pennies a Day

Thanks to a little-known life insurance program, Americans aged 50 to 85 are now securing up to $50,000 in burial coverage — often for less than $2 a day.

These policies are designed specifically for seniors — with guaranteed acceptance in most states, no doctor visits, and fast approval.

In fact, over 1 million Americans have already taken advantage of this type of plan to make sure their families are protected.

Why Are So Many Seniors Taking Advantage of This Program?

According to the National Funeral Directors Association, funeral costs have increased by over 65% in the past 15 years — with no signs of slowing down.

That’s why so many people are locking in their rates now, before prices climb even higher.

✅ No Medical Exam Required

✅ No Waiting Period in Many Cases

✅ Covers Funeral, Cremation, and Final Expenses

✅ Fast Online Application — No Pushy Sales Calls

There’s No Risk to See If You Qualify — And It Won’t Affect Your Credit

The process to check eligibility is fast, secure, and private. It won’t impact your credit score, and you’ll know within minutes how much coverage you may qualify for.

Imagine the peace of mind you’d feel knowing your family won’t be scrambling to cover funeral costs during one of the most difficult moments of their life.

Here’s How to Get Started:

Step 1: Click your state on the map below

Step 2: Answer a few quick questions (takes less than 60 seconds)

Step 3: Instantly see how much coverage you may qualify for

Important Disclosures

Dignity Health Solutions and its affiliates do not guarantee that enrolled debts will be resolved for a specific amount or within a specific timeframe. All programs are dependent on individual financial circumstances, creditor participation, and the client’s ability to save sufficient funds for settlement.

We do not assume or pay your debts, make monthly payments to creditors, or provide tax, legal, or credit repair services. Our services are not available in all states, and fees may vary depending on location. Please consult with a qualified tax advisor regarding any potential tax consequences resulting from debt settlement.

The use of debt relief services may negatively impact credit scores and could result in collection activity or legal action by creditors. However, successfully settled debts typically resolve the entire balance, including accrued interest and fees.

Average results based on prior client data, which showed an average enrolled balance of $25,320 resolved over approximately 43 months.

Statistics reflect the outcomes of clients served since 2002 by Dignity Health Solutions and affiliate programs (as of January 2024).